working capital funding gap in days

Get the most detailed and comprehensive venture capital data. Go to the LendingTree Official Site Get Offers.

Ifundwomen Brand Architecture Brand Manifesto Startup Funding

According to a recent working capital practices study of the manufacturing and distribution industry 161 percent of accounts receivable are still in the bush 180 days after.

. Working capital can be negative if current liabilities are greater than current assets. Ad Get Working Capital Funding Fast. Days in the period.

However if the company made 12 million in. The cash gap is 90 days so the company will have to borrow enough to cover 90 days cost of goods. On February 25 2022.

Go to the LendingTree Official Site Get Offers. We recognize that all business owners. We offer a wide variety of products and constantly look to add to our program offerings.

For instance if your supplier terms are 30 days and your customer terms are 60 days you will have a cash flow gap. The days working capital is calculated by 200000 or working capital x 365 10000000. A funding gap is the amount of money needed to fund the ongoing operations or future development of a business or project that is not currently provided by.

Compare up to 5 Loans Without a Hard Credit Pull. The keys to managing the cash flow gap are as follows. Why the Working Capital Funding Gap Exists.

Compare up to 5 Loans Without a Hard Credit Pull. This is considered accounts receivable and leaves a gap of 20 days before the company receives payment and the working capital cycle is complete. 456 Days in the period.

The working capital formula tells us the short-term liquid assets available after short-term liabilities have been paid. This ratio measures how efficiently a company is able to convert its working capital into revenue. It is a long term and flexible working.

Work to match up the days outstanding for trade payables with the days outstanding for accounts receivable. Of course the effect of. The cost of goods sold for one days revenues is 60 of 200 million or 120 million.

472 Inventory days. Again any lack of control letting inventory levels rise can cause severe cash flow problems. 345 Payable days.

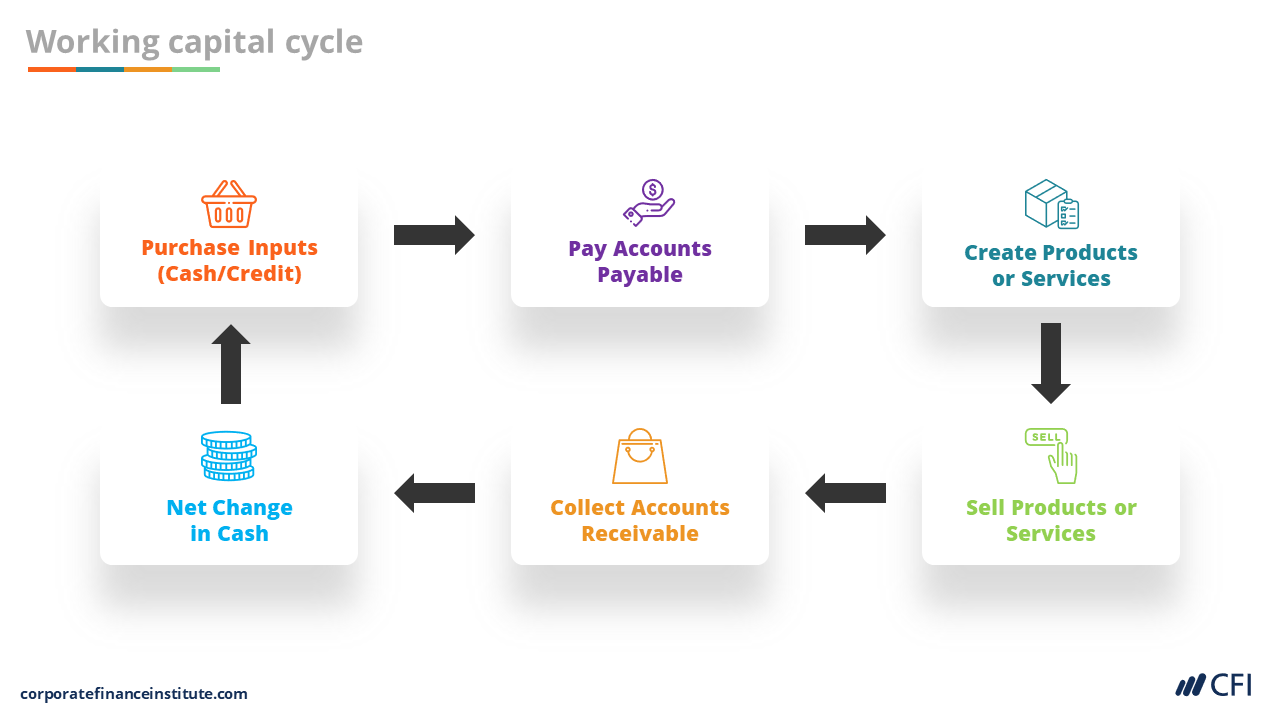

Ad Get Working Capital Funding Fast. Working Capital Days Receivable Days Inventory Days Payable Days. Maintenance capital expenditures refer to capital expenditures that are necessary for the company to continue operating in its current form.

Working Capital Current Assets Current Liabilities. Whats the companys working capital funding gap in days based on the information below. 365 413 361 583 329 Based on the information below how much does the company need to finance.

Gaining a few days. Finance questions and answers. Working Capital Financing is when a business borrows money to cover day-to-day operations and payroll rather than purchasing equipment or.

Working Capital is a general term for commercial financing. The inventory working capital requirement is 9000 or 49 of revenue. Working capital gap Current assets current liabilities other than bank borrowings For exampleCurrrent if current asset is 100 and current liabilities is 80bank.

Days working capital 73 days.

Working Capital Cycle Understanding The Working Capital Cycle

Capital Employed Accounting And Finance Financial Management Shopify Business

Treasury Essentials The Cash Conversion Cycle The Association Of Corporate Treasurers

:max_bytes(150000):strip_icc()/dotdash_Final_How_Do_You_Calculate_Working_Capital_Aug_2020-01-a35d03d74be84f8aa3ad4c26650142f6.jpg)

How Do You Calculate Working Capital

Working Capital What Is Working Capital Youtube

Working Capital Cycle Understanding The Working Capital Cycle

Working Capital Cycle Efinancemanagement

Angel Investors Angel Investors Finance Investing Finance Saving

Epingle Sur Travel And Ecommerce

How Crowdfunding Fills The Small Business Funding Gap By Local Stake Small Business Funding Crowdfunding Infographic Crowdfunding

Venture Capital Is Losing Sight Of Its Most Important Investments Seed Stage Entrepreneurs Venture Capital Investment In India Investing

Pin On Small Business Blogging Hiring News Tips Access Profiles Inc

Cash Flow Cycles And Analysis I Finance Course I Cfi

Immediate Financing Options Trade Finance Supply Chain Finance

Working Capital Financial Edge Training

Days Working Capital Formula Calculate Example Investor S Analysis

Goldman Sachs Infographic Social Impact Bonds Social Impact Social Entrepreneurship Investing Infographic

/workingcapital.asp-Final-7145e98d92d446938fa2123de0f36220.png)

0 Response to "working capital funding gap in days"

Post a Comment